Monte Carlo Simulations

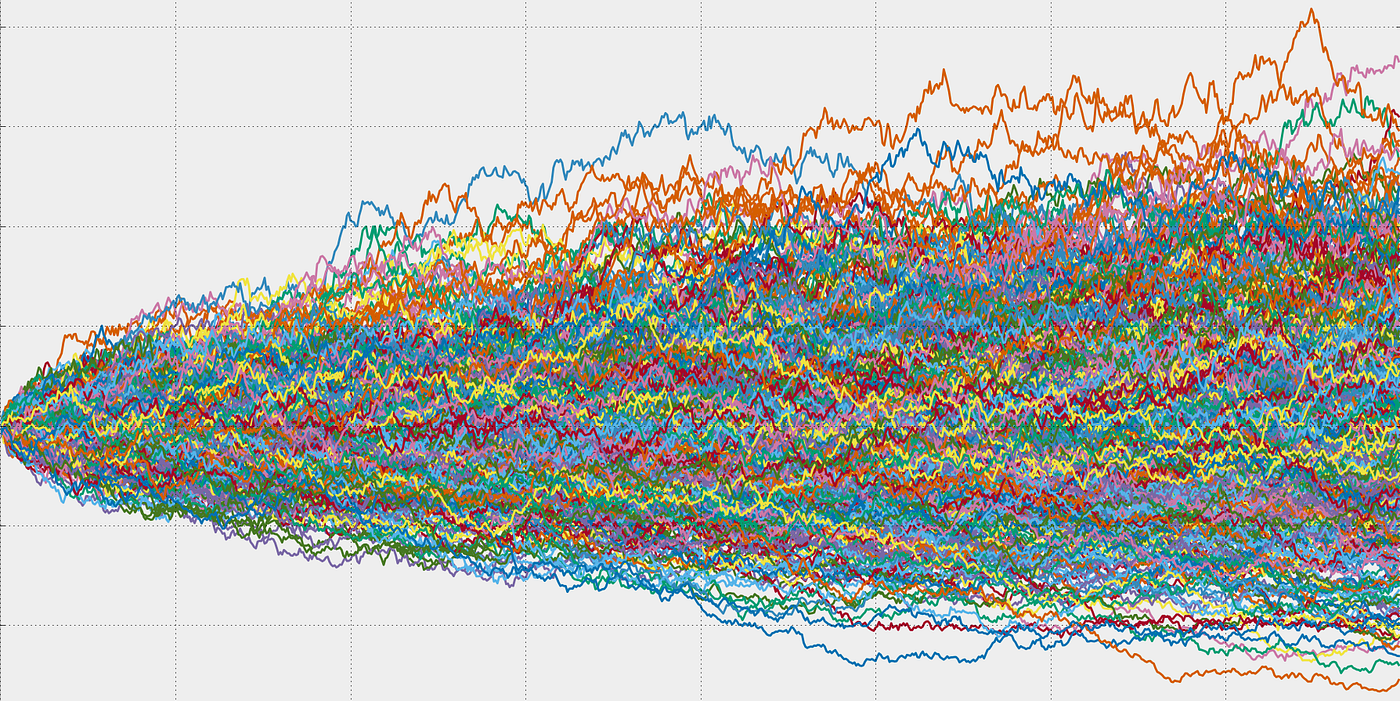

Monte Carlo simulations, named after the renowned Monte Carlo Casino, are extensively employed in finance to model and analyze complex scenarios. At their core, these simulations use random sampling to generate a multitude of potential outcomes for a given financial problem. By simulating numerous market conditions, financial analysts gain valuable insights that aid in making well-informed decisions amidst the inherent uncertainties of the financial world.

One of the primary applications of Monte Carlo simulations in finance is risk assessment. By simulating various market scenarios, these simulations allow analysts to quantify the potential risks associated with investment strategies, market fluctuations, and economic variables. This enables financial professionals to develop risk mitigation strategies and make strategic decisions that consider a broad range of possible outcomes.

Monte Carlo simulations have become an indispensable tool in the realm of finance, offering a sophisticated means to navigate uncertainties and make informed decisions. Whether assessing risks or pricing options, financial professionals leverage these simulations to gain a comprehensive understanding of potential market scenarios. As financial landscapes continue to evolve, Monte Carlo simulations will likely remain a cornerstone in the strategic toolkit of analysts and investors alike, providing invaluable insights in the face of complex financial challenges.